Find Your Path with a Debt Relief Attorney

Understanding the Role of a Debt Relief Attorney

Facing overwhelming debt can be daunting, but a debt relief attorney offers a crucial lifeline. These professionals specialize in helping individuals and businesses manage and reduce their financial burdens. They provide expert advice on strategies like negotiation, consolidation, or even bankruptcy to regain control over finances. For example, if you’re struggling with credit card debt, a debt relief attorney might negotiate with creditors to lower interest rates or reduce the total amount owed.

Key Benefits of Hiring a Debt Relief Attorney:

- Expert Guidance: They provide personalized advice tailored to your financial situation, ensuring you select the most effective debt relief strategy.

- Negotiation Skills: Their experience allows them to secure better terms with creditors, potentially saving you significant amounts of money.

- Legal Protection: They safeguard your rights throughout the debt relief process, preventing creditor harassment.

Consider Jane, a small business owner overwhelmed by debt after a challenging year. With the help of a debt relief attorney, she consolidated her debts, reduced monthly payments, and ultimately saved her business. This example underscores the transformative impact a debt relief attorney can have. In conclusion, while tackling debt can be intimidating, remember you’re not alone. A debt relief attorney can be your ally, guiding you with expertise and empathy toward financial freedom, whether dealing with personal or business liabilities.

How a Debt Relief Attorney Can Help You Navigate Financial Challenges

Facing financial difficulties can be daunting, but a debt relief attorney offers the guidance needed to regain control. These professionals specialize in managing and reducing debt for individuals and businesses, providing crucial support when financial challenges seem overwhelming. Here’s how they can assist you. A debt relief attorney provides personalized advice tailored to your unique situation, helping you understand options like debt consolidation, negotiation, or bankruptcy. For example, if you’re burdened with credit card debt, they might negotiate with creditors to lower interest rates or settle for a reduced amount.

Key ways a debt relief attorney can assist you include:

- Expert Guidance: Offering insights into complex legal and financial matters to ensure informed decisions.

- Negotiation Skills: Negotiating with creditors on your behalf to potentially reduce the total debt.

- Legal Protection: Shielding you from aggressive collection practices and upholding your rights.

Consider a small business owner overwhelmed by debt due to unforeseen circumstances. A debt relief attorney could help restructure their debt, allowing the business to continue operating while gradually paying off creditors. This example underscores the transformative impact a skilled attorney can have on financial health. Ultimately, a debt relief attorney is more than a legal advisor; they are a partner in your journey toward financial stability. By leveraging their expertise, you can confidently navigate financial challenges and work towards a secure future.

Ready to connect with top legal professionals? Get immediate support— Call us at 877-550-8911.

Top Reasons to Hire a Debt Relief Attorney for Your Financial Crisis

Facing a financial crisis can feel overwhelming, like navigating a maze without a clear path. This is where a debt relief attorney becomes invaluable, guiding you towards financial stability. But why should you consider hiring one? Here are the key reasons.

Expertise and Experience: Debt relief attorneys possess extensive knowledge of bankruptcy laws and debt negotiation strategies, which can be daunting for most individuals. For example, if you’re dealing with foreclosure, an attorney can help explore options such as loan modification or short sale, potentially saving your home.

Tailored Solutions: Each financial situation is unique, and a debt relief attorney provides personalized advice suited to your specific needs. They assist in determining whether bankruptcy is appropriate or if alternatives like debt consolidation are more advantageous. This customized approach ensures that your financial challenges are addressed effectively.

- Protection from Creditors: Hiring a debt relief attorney means they manage all communications with creditors, eliminating harassing calls and letters, and allowing you to focus on rebuilding your financial health.

- Legal Representation: If your case goes to court, having an attorney ensures your rights are protected and you have professional advocacy.

In conclusion, a debt relief attorney can significantly impact managing your financial crisis, offering expertise, personalized solutions, and legal protection to help you regain control of your financial future.

Exploring the Benefits of Consulting a Debt Relief Attorney

Dealing with debt can be daunting, especially when you’re unsure of the best course of action. This is where a debt relief attorney becomes an invaluable resource. These professionals offer expert guidance and customized solutions, helping you regain control over your financial future. But what makes consulting a debt relief attorney so advantageous?

Expertise and Knowledge Debt relief attorneys possess extensive knowledge and experience in bankruptcy laws and debt negotiation strategies. This ensures you receive informed and practical advice. Key benefits include:

- Personalized Solutions: They provide tailored solutions specific to your financial situation.

- Legal Protection: Attorneys protect you from aggressive creditors and uphold your rights.

- Stress Reduction: By managing complex paperwork and negotiations, they significantly reduce the stress of debt management.

Real-World Impact Take Jane’s story, for example. As a single mother overwhelmed by credit card debt, she consulted a debt relief attorney. This decision allowed her to consolidate her debts and negotiate lower interest rates, saving her thousands of dollars. Such real-world examples demonstrate how professional guidance can turn financial despair into manageable solutions. In summary, consulting a debt relief attorney offers more than legal advice; it provides peace of mind and a clear path to financial recovery. Whether you’re considering bankruptcy or exploring alternative debt solutions, their expertise can unlock a brighter financial future.

What to Expect During Your First Meeting with a Debt Relief Attorney

Your first meeting with a debt relief attorney is a pivotal step towards financial stability. This initial consultation is designed to be both informative and supportive, helping you navigate your financial challenges with confidence. Initial Assessment and Discussion The meeting begins with your attorney assessing your financial situation. This is your opportunity to discuss everything from outstanding debts to income sources. Don’t worry about judgment; the attorney is there to help, not criticize. They’ll use this information to craft a strategy tailored to your needs.

- Review of Financial Documents: Be ready to share documents like credit card statements and loan agreements.

- Understanding Your Goals: Clearly communicate your objectives, whether it’s reducing debt or avoiding bankruptcy.

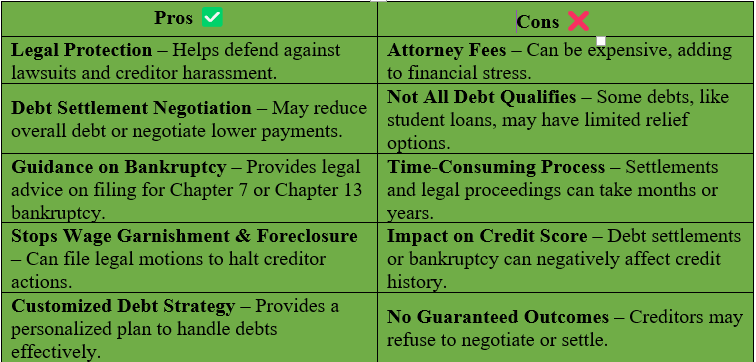

Exploring Debt Relief Options With a clear understanding of your finances, the attorney will outline potential debt relief options. These might include debt consolidation, negotiation with creditors, or even bankruptcy if necessary. They’ll explain the pros and cons of each, aiding your decision-making process.

- Debt Consolidation: Simplifies finances by combining debts into a single payment.

- Negotiation: Attorneys can negotiate lower interest rates or settlements.

Next Steps and Action Plan By the meeting’s end, you’ll have a clearer path forward. Your attorney will provide a roadmap detailing the next steps, such as gathering more documents or starting debt negotiation. This meeting aims to empower you with knowledge and a plan, marking a significant step towards financial freedom.

Key Questions to Ask Your Debt Relief Attorney Before Hiring

Choosing the right debt relief attorney can be a game-changer when you’re overwhelmed by debt. To ensure you’re making the best choice, it’s essential to ask the right questions. Here are some crucial inquiries to guide your decision.

1. What is Your Experience with Debt Relief Cases? It’s vital to know your attorney’s background. Look for someone with a proven track record in handling cases like yours, whether it involves bankruptcy, debt settlement, or negotiation. An experienced attorney will provide valuable insights and examples, boosting your confidence in their capabilities.

2. What Are Your Fees and Payment Options? Understanding the cost structure is crucial to avoid unexpected expenses. Ask about their fee schedule and if they offer payment plans. Some attorneys might work on a contingency basis, meaning they only get paid if you win. This knowledge helps you plan your finances better.

3. How Will You Communicate with Me Throughout the Process? Effective communication is key to a successful attorney-client relationship. Inquire about the frequency and mode of updates—whether through email, phone, or meetings. A reliable attorney will keep you informed and engaged throughout the process.

4. Can You Provide References or Testimonials? References from past clients can offer insights into an attorney’s effectiveness and service quality. Request testimonials or check online reviews. Positive feedback can assure you of making the right choice. By asking these questions, you ensure your debt relief attorney is both qualified and a good fit, providing guidance and peace of mind during challenging times.

Common Misconceptions About Debt Relief Attorneys Debunked

Many people hesitate to seek help from a debt relief attorney due to common misconceptions. Let’s debunk these myths to help you make informed decisions.

Misconception 1: Debt Relief Attorneys Are Only for Bankruptcy Debt relief attorneys do more than guide you through bankruptcy. They offer services like negotiating with creditors, consolidating debts, and advising on credit score improvement. For example, they might help settle a debt for less than owed, saving you money and stress.

Misconception 2: Hiring a Debt Relief Attorney Is Too Expensive Contrary to popular belief, hiring a debt relief attorney can be cost-effective. They can negotiate lower interest rates or reduce the total amount owed, potentially saving you thousands. Many attorneys also offer flexible payment plans or free initial consultations, making their services more accessible.

Misconception 3: I Can Handle Debt Relief on My Own While some manage debts independently, a debt relief attorney’s expertise can make a significant difference. They understand legal intricacies and have relationships with creditors, leading to more favorable outcomes. Just as you would hire a mechanic for car repairs, a debt relief attorney is a specialist who efficiently navigates debt complexities. Understanding these misconceptions allows you to approach debt relief with confidence, knowing a debt relief attorney can provide practical and effective solutions during challenging financial times.

How to Choose the Right Debt Relief Attorney for Your Needs

Selecting the right debt relief attorney is crucial when you’re under financial stress. The right professional can guide you through complex debt relief options and help you regain financial control. Here’s how to find the right one. Experience is key. Seek an attorney specializing in debt relief with a successful track record. Such an attorney will understand debt laws and provide strategic advice tailored to your situation. For example, if you’re struggling with credit card debt, an attorney experienced in negotiating with credit card companies can be particularly helpful. When assessing potential attorneys, consider these factors:

- Reputation: Look for online reviews and request references. A reputable attorney will have positive client testimonials.

- Communication: Opt for someone who communicates clearly and promptly, ensuring you’re informed throughout the process.

- Fees: Clarify their fee structure upfront. Many attorneys offer a free initial consultation, allowing you to gauge their approach and compatibility.

Lastly, trust your instincts. During your consultation, observe how the attorney interacts with you. Are they attentive and empathetic? A good debt relief attorney provides not only legal expertise but also emotional support. By considering these factors, you can find an attorney who will be a true ally in your journey toward financial freedom.

The Impact of a Debt Relief Attorney on Your Financial Future

Dealing with debt can be daunting, but a debt relief attorney can guide you toward financial stability. These professionals specialize in crafting personalized solutions that align with your financial goals, offering both legal expertise and strategic debt management. A debt relief attorney can help you breathe easier by negotiating with creditors, consolidating debts, or guiding you through bankruptcy if needed. Their role extends beyond immediate debt relief, providing you with the tools to make informed financial decisions.

Key Benefits of Hiring a Debt Relief Attorney:

- Expert Guidance: They possess extensive knowledge of debt laws, helping you navigate complex financial situations.

- Negotiation Skills: Attorneys can often secure better terms with creditors, potentially lowering your overall debt.

- Stress Reduction: With a professional managing your case, you can focus on rebuilding your financial health without constant creditor pressure.

Take Jane, a small business owner who faced overwhelming debt after a downturn. With the help of a debt relief attorney, she restructured her debts and saved her business. This example highlights the significant impact these attorneys can have on your financial future. Ultimately, a debt relief attorney empowers you to make smarter financial choices, paving the way for a secure future. Whether facing personal or business debt, their expertise can be transformative in achieving financial freedom.

FAQ

-

What does a debt relief attorney do?

They help negotiate, settle, or discharge debts through legal means. -

Can a debt relief attorney stop creditor harassment?

Yes, they can file cease-and-desist letters or take legal action. -

How much does a debt relief attorney cost?

Fees vary but range from $500 to $5,000, depending on the case. -

Do I need a debt relief attorney for bankruptcy?

Yes, they guide you through filing and maximize your chances of approval. -

How do I find a reputable debt relief attorney?

Look for licensed attorneys with positive reviews and a strong track record.

Don’t wait to secure the legal representation you deserve. Visit Legal Case Review today for free quotes and tailored guidance, or call 877-550-8911 for immediate assistance.

You can visit TheLawyerDirectory to find the best Lawyer.